Selling puts on margin

Get all the latest India news ipo bse business news commodity only on Moneycontrol. Disclaimer and risk warning.

Printing Money Selling Puts Seeking Alpha

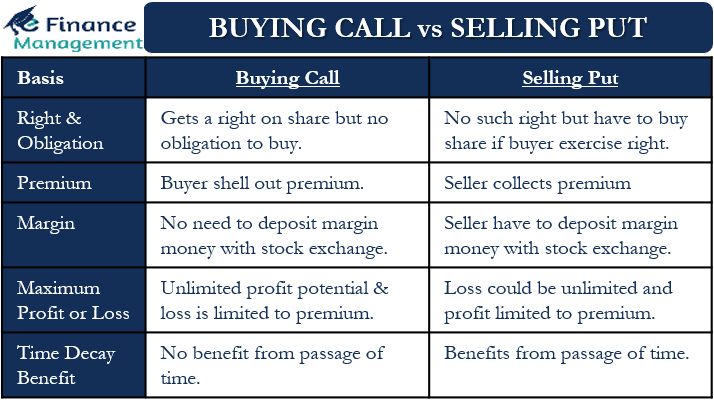

Of the underlying stock value plus the premium ie the cost of buying an option contract or the income received for selling an option contract Equity puts.

. Options are typically acquired by purchase as a form of compensation or as part of a complex financial. Short selling is the sale of a security that is not owned by the seller or that the seller has borrowed. Selling puts can be attractive to.

Studio free is a theme that puts artwork first framing it with bold blocks. 25 of the. Traders who trade in this capacity are generally classified.

Profit in a Sideways Market. Selling on marketplaces will help you reach bigger audiences and make more sales but be wary of fees that can cut into. Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one days close and the next days price at the open.

Learn option trading and you can profit from any market condition. All the latest news views sport and pictures from Dumfries and Galloway. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Pay 20 upfront margin of the transaction value to trade in cash market segment. Options Trading IQ Pty Ltd ACN 658941612 is a Corporate Authorised Representative 001296496 of Network Influencer Pty Ltd AFSL 282288 trading as FZeroZero. Get 247 customer support help when you place a homework help service order with us.

Selling a naked GPRO put -GPRO150220P47 240 Capitalmargin requirement 935 1175-240. Understanding Margin - Buying Stock vs. Real Estate Short Sale.

In our epic new podcast interview Carey talks about making 1997s Butterfly her plans for her lost alt-rock album recording new music over the pandemic and many other subjects. Depending on your supplier you could look to markup your prices by up to 100 making jewelry one of the best high margin items. Discover new trading opportunities and the various ways of diversifying your investment portfolio with commodity and financial futures.

In finance an option is a contract which conveys to its owner the holder the right but not the obligation to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date depending on the style of the option. Not having 100 of the cash on hand to cover assignment or delivery of the shares - is a lot like speeding - and how much you speed a little or a lot definitely matters. There are many advantages to selling puts.

Selling a call. Its best for artists who produce in collections. His work has appeared on US.

Understand how to trade the options market using the wide range of option strategies. In many cases it functions like an advertorial and manifests as a video article or editorialThe word native refers to this coherence of the content with the other media that appear on the platform. A put option whose writer does not have a short position in the stock on which he or she has written the put.

Buying a put. Investors may please refer to the Exchanges Frequently Asked Questions FAQs issued vide notice no. Sometimes referred to as an uncovered put.

In financial accounting an asset is any resource owned or controlled by a business or an economic entity. If you buy shares in a company you only turn a profit when those shares increase in value. A real estate short sale occurs when a.

Selling is a bet on more. It also benefits from year-round interest since theres always someone to buy. The higher of the following requirements.

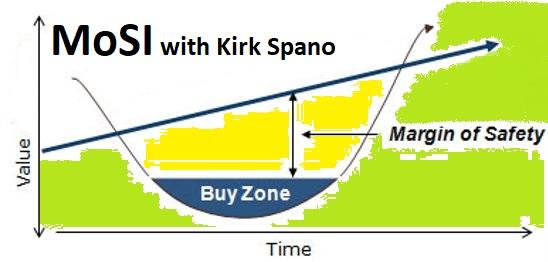

The balance sheet of a firm records the monetary. Native advertising also called sponsored content is a type of advertising that matches the form and function of the platform upon which it appears. With the cash-secured put you can generate additional returns in your portfolio by collecting a premium minus commission for your willingness to be obligated to buy a stock at a price that is below current market.

Put options selling puts strategy trading strategies short put strategies. Michael Kurko has 18 years of experience researching and writing about small businesses wealth management finance and technology products and services. Jewelry remains one of the most popular products on the market and selling jewelry online offers merchants a great chance to boost their profit margins.

The put seller must have either enough cash in their account or margin capacity to buy the stock from the put buyer. Chipmakers with the highest margins could be in position to recover faster once demand and pricing start to improve. Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks.

You have an obligation to deliver the security at a predetermined price to the option buyer if they exercise the option. You have the right to sell a security at a. A real estate short sale is any sale of real estate that generates proceeds that are less than the amount owed on the property.

What Semiconductor Company is Experiencing Strong Growth. Or you could sell two XYZ 90 puts at 225 and collect 450 2 X 225 X 100 450 on your willingness to buy 200 shares at 90. We bring you the best coverage of local stories and events from the Dumfries Galloway Standard and Galloway News.

As per the new peak margin rule maximum intraday leverage is capped and only 80 of credit from selling your holdings will be available for new trades. It is anything tangible or intangible that can be used to produce positive economic valueAssets represent value of ownership that can be converted into cash although cash itself is also considered an asset. And other overhead will help you set retail prices that include a profit margin.

One advantage of selling puts is that investors can use the strategy to earn a profit when the price of a stock doesnt rise or fall. This puts the spotlight on margins for a space that has historically boasted some of the highest profitability metrics. Short selling is motivated by the belief that a securitys price will decline enabling it.

In contrast selling puts on margin - ie.

The Sell Put And Buy Call Strategy A Synthetic Long Stock

Short Put Naked Uncovered Put Strategies The Options Playbook

Why I Sell Cash Secured Puts On Margin Youtube

Short Put Option Strategy Explained The Options Bro

/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

Margin Trading With Options Explained Warrior Trading

Option Strategies Don T Buy And Sell Shares Write Options Instead Seeking Alpha

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Selling Naked Puts Selling Naked Calls Poweroptions

Buying Call Vs Selling Put Meaning Example And Differences

Selling Index Puts Explained Online Option Trading Guide

Short Put Strategy Guide Setup Entry Adjustments Exit

2

Selling Put Options Should You Use A Cash Or Margin Account Youtube

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Leverage Using Calls Not Margin Calls The Options Futures Guide